Financial Plan: How to Generate Passive Income from Property for Retirement

Last Updated on January 15, 2026

- 1. Quick Answers: How Many Properties for Your Income Goal?

- 2. The Simple Formula for Retiring on Rentals

- 3. Step 1: Define Your Retirement Income Goal

- 4. Step 2: Calculate Your Net Cash Flow Per Property (The Critical Metric)

- 5. How Many Rental Properties Do You Need to Retire? Calculate Your Number

- 6. Localization for UAE Investors: Dubai-Specific Costs

- 7. Retirement Scenarios: Paid-Off vs. Leveraged vs. Hybrid

- 8. Key Financial Metrics for Your Real Estate Investment Portfolio

- 9. Crafting a Long-Term Strategy for Your Property Portfolio

- 10. Comparing Investment Strategies: Long-Term vs. Vacation Rentals

- 11. Key Factors That Will Change Your “Magic Number”

- 12. Risks, Pitfalls, and How to Protect Your Portfolio

- 13. Accelerate Your Timeline: Retire Faster with Real Estate

- 14. Frequently Asked Questions (FAQ)

- 15. Your Path to Financial Independence Starts Now

- 16. Our Investment Specialists

Quick Answers: How Many Properties for Your Income Goal?

For a quick estimate, here’s how many properties you might need based on a common net cash flow per door. Use our calculator below for a personalized result.

- To make $50,000/year: You’d need approximately 10 properties, each generating about $417/month in net cash flow.

- To make $75,000/year: You’d need approximately 15 properties, each generating about $417/month in net cash flow.

- To make $100,000/year: You’d need approximately 20 properties, each generating about $417/month in net cash flow.

These are illustrative examples. Your actual number will depend on your specific market, financing, and expenses.

The Simple Formula for Retiring on Rentals

The entire calculation boils down to one simple formula. This is the core of your financial plan. It directly answers how many rental properties you need to retire.

The formula is: Number of Properties = Target Annual Income / Annual Net Cash Flow Per Property.

That’s it.

But the devil is in the details, specifically in calculating the “Net Cash Flow.” It’s your gross rental income minus all the associated costs.

Net Cash Flow = Gross Rental Income − (PITI + Vacancy + Maintenance + CapEx + Management + Utilities + HOA/other recurring costs)

I always advise clients to start with their monthly targets, as they’re easier to grasp, and then convert them to annual figures for the final calculation. It keeps the numbers grounded.

A pro tip from my experience: always sanity-check your final number. Run the calculation with a conservative, base, and optimistic cash flow estimate. The truth will likely land somewhere in the middle, but this range-testing prepares you for the worst-case scenario.

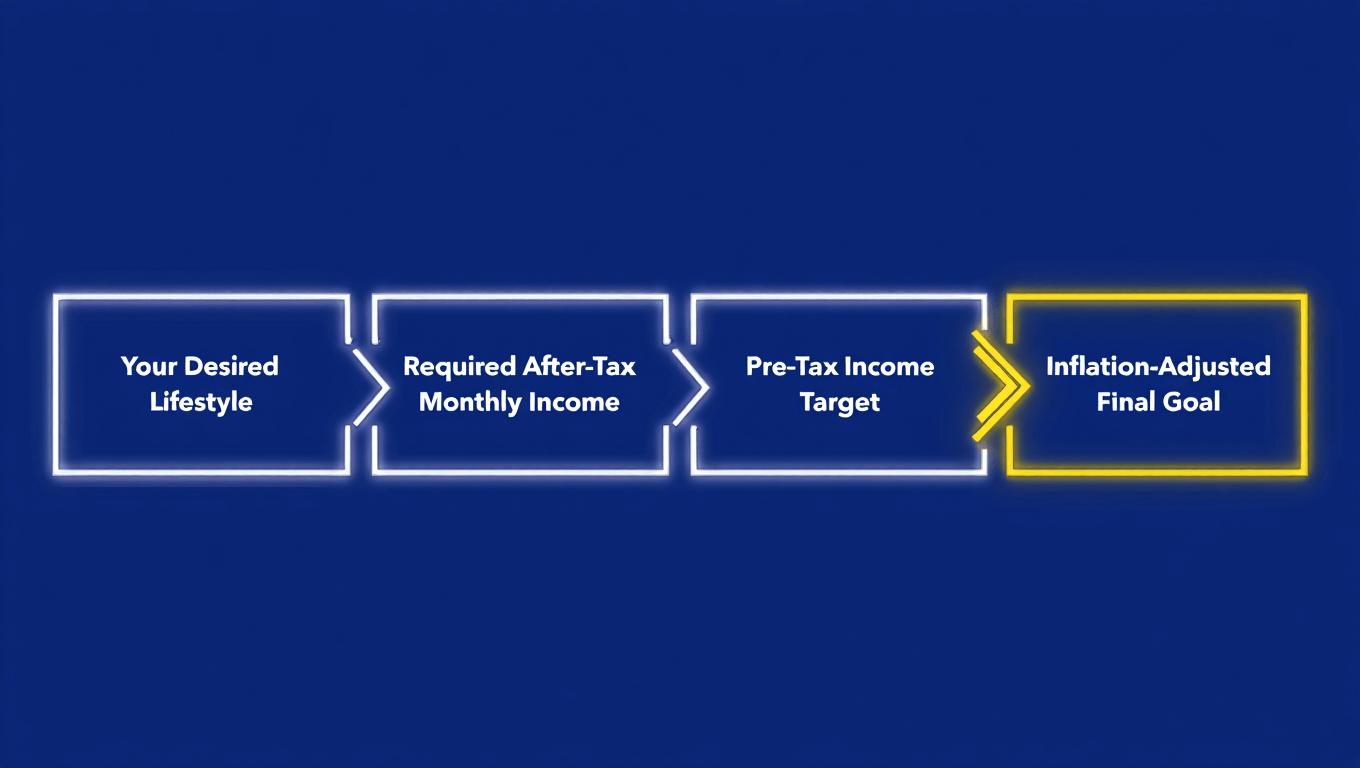

Step 1: Define Your Retirement Income Goal

Before you can figure out how many properties you need, you must define the target. This section helps you determine your lifestyle number. Keep it outcome-first: how much after-tax income do you want to have in your bank account every month during retirement?

How to Calculate Your Annual Retirement Expenses

The best place to start is your current after-tax spending. Look at your bank statements for the last 6-12 months. Then, adjust. Subtract costs that will disappear in retirement, like commuting or work-related lunches. Now, add the new costs: increased healthcare, more travel, hobbies, and other lifestyle upgrades you’re planning. For a structured approach, consider using a budgeting tool.

Finally, add a buffer. I always recommend a 10-20% buffer for the unknowns. Life happens. Unexpected repairs, family needs, or just a sudden desire for a big trip. This buffer is your peace of mind.

Factoring in Taxes and Inflation

Disclaimer: This information is for educational purposes only and does not constitute financial or tax advice. Consult with a qualified professional for guidance tailored to your specific situation.

The income your properties generate isn’t all yours; the tax man gets his share. You need to calculate your pre-tax goal. The formula is: Retirement Target Before Tax = Desired After-Tax Income / (1 − Effective Tax Rate). Your effective tax rate will depend on your location and income level, so it’s crucial to get this right.

Then there’s inflation, the silent portfolio killer. If your retirement is more than a decade away, you absolutely must account for it. A simple way is to increase your target income goal by 2-3% for every year until you retire.

“For more precise models, investors should use historical data to project future needs. Long-term inflation trends are critical for accurate retirement planning.” — OECD Data, (2025). data.oecd.org

Step 2: Calculate Your Net Cash Flow Per Property (The Critical Metric)

This is the most important number in your entire plan. Get this wrong, and everything else falls apart. This section breaks down how to accurately estimate your income and, more importantly, all your expenses.

What is Net Cash Flow? (Income − All Expenses)

Simply put, cash flow is what’s left in your pocket after you’ve paid every single recurring cost associated with the property. It’s not your gross rent. It’s the real, spendable profit. This is the fuel for your retirement math. A property with negative or zero cash flow is a liability, not an asset for retirement income.

Estimating Income (Gross Rent, Vacancy Rate)

First, determine your Gross Rent by looking at comparable leases (“comps”) in the immediate area for similar properties. Be realistic. Then, factor in vacancy.

“While a 5-8% vacancy rate is a common benchmark for stabilized properties, this can vary significantly based on local market dynamics and property type.” — Institute of Real Estate Management (IREM), (2025). irem.org

Don’t forget to add other potential income sources like pet fees, parking charges, or shared utility billing (RUBS).

Estimating Expenses (PITI, Maintenance, CapEx, Management, etc.)

This is where investors often get into trouble. You must be brutally honest here.

- PITI: Principal, Interest, Taxes, and Insurance. Your mortgage payment plus property taxes and hazard insurance.

- Maintenance: For ongoing repairs. A common rule of thumb is 5-8% of the gross rent.

- CapEx (Capital Expenditures): This is for the big-ticket items: a new roof, HVAC system, major appliance replacements. Budget another 5-10% of rent for this. It’s not if it will happen, but when.

“Budgeting 5-8% of gross rent for maintenance and another 5-10% for CapEx is a standard industry heuristic to avoid being caught off guard by major expenses.” — U.S. Department of Housing and Urban Development (HUD), (2025). hud.gov

- Property Management: Even if you manage it yourself, pay yourself. If you hire out, budget 8-10% of collected rent.

“Professional property management fees typically range from 8-10% of collected rent, a crucial line item for calculating true net operating income.” — Buildium, Annual Property Management Industry Report, (2025). buildium.com

- Vacancy Allowance: The income you lose from the vacancy rate calculated above.

- Utilities/HOA: Any utilities you cover for the tenant and any Homeowners’ Association fees.

- Reserves: This isn’t an expense, but a necessity. You should have at least 3-6 months of total expenses set aside in a separate account for each property. This is a widely accepted best practice for risk management.

“New investors focus on the purchase price. Experienced investors obsess over the operating expenses. CapEx and vacancy can turn a seemingly profitable deal into a money pit. Always underwrite conservatively and assume things will cost more and take longer than you expect.” — Zoe Hernandez, Realtor at Anika Property

Rules of Thumb (1% / 50% / 2%): Quick Screens vs. Full Underwriting

Heuristics like the 1% and 50% rules can be useful for quickly filtering deals, but they are not a substitute for a detailed expense analysis.

- The 1% Rule: Suggests a property’s monthly rent should be at least 1% of its purchase price (e.g., a $200,000 property should rent for at least $2,000/month). It’s a fast check for potential cash flow but ignores varying expenses.

- The 50% Rule: States that you should assume half of your gross rental income will go toward operating expenses (excluding the mortgage payment). For a property renting at $2,000/month, this rule estimates $1,000 in monthly operating costs. It’s a blunt instrument that can be inaccurate in high-tax or high-maintenance areas.

- The 2% Rule: An older, more aggressive version of the 1% rule, suggesting monthly rent should be 2% of the purchase price. This is often considered outdated and unrealistic in most of today’s markets.

Use with caution: These rules are for initial screening only. Always perform a full, line-item underwriting as detailed in the table below before making an investment decision.

| Metric | Rule of Thumb | Range | Notes |

|---|---|---|---|

| Vacancy | 5% of Gross Rent | 3-10% | Higher for seasonal markets or turnover-heavy properties. Varies significantly by locality; input your exact quotes. |

| Maintenance | 8% of Gross Rent | 5-10% | Covers routine repairs like leaky faucets, running toilets. |

| CapEx | 8% of Gross Rent | 5-15% | For major replacements (roof, HVAC, water heater). Crucial but often ignored. |

| Management | 10% of Collected Rent | 8-12% | Standard fee for professional management. Budget this even if self-managing. |

| Taxes | Varies by location | 0.5-3% of Value | Varies significantly by locality; check local municipality records for exact rates. |

| Insurance | Varies by location/coverage | 0.3-1% of Value | Depends on property type, location (flood/fire zones), and coverage level. |

| Utilities | Varies | $0 – $XXX | Depends on what you, as the landlord, are responsible for. |

How Many Rental Properties Do You Need to Retire? Calculate Your Number

There’s no universal “how many properties to retire” answer. It’s deeply personal. Enter your desired passive income and the average net cash flow per property from your investment properties to get a personal estimate. This calculator uses the relationship between rental properties’ cash flow and rental income relative to capital to approximate how many units can drive your financial independence. It allows for detailed inputs like vacancy, management fees, and maintenance costs to provide a more accurate result.

Calculate Your Retirement Number

Localization for UAE Investors: Dubai-Specific Costs

For international investors, especially in the UAE, using U.S.-based expense ratios can be misleading. Here’s a breakdown of typical costs in Dubai to help you create a more accurate forecast.

- Mortgages for Non-Residents: LTV ratios for non-residents are typically lower, often capped at 50-75%. Banks will assess affordability based on your global income and require a Debt Service Ratio (DSR) calculation. Initial costs include a DLD fee (4% of property value), valuation fees, and bank arrangement fees.

- Taxes: The UAE does not levy income tax on rental earnings for individuals. However, there is a 5% VAT on property management and other professional services, and municipalities may charge fees (e.g., 5% of the annual rent value in Dubai, collected via utility bills). Investors must also consider tax obligations in their country of residence and any applicable Double Taxation Treaties (DTT).

- Service Charges: These are significant in Dubai and cover building maintenance, security, and amenities. They are charged per square foot and can range from AED 15 to AED 30+ psf annually depending on the community and building quality. Always verify the exact service charges for a specific property.

| Expense (Dubai) | Typical Range (AED) | Notes |

|---|---|---|

| Service Charges | AED 15 – 30+ per sq. ft. / year | Varies widely by community (e.g., JVC vs. Dubai Marina). |

| Property Management | 5% – 8% of annual rent | Standard fee for full-service management. |

| Vacancy | 5% – 10% (LTR), 15-25% (STR) | LTR is more stable; STR is seasonal. Check market reports from Bayut/Property Finder. |

| DEWA (Utilities) | Tenant’s responsibility (usually) | Landlord may cover if included in rent (e.g., holiday homes). |

| Ejari Fee | ~AED 220 per contract | Mandatory registration of tenancy contracts in Dubai. |

| Holiday Home License | AED 370 + annual fees | Required for short-term rentals (STR), managed via Dubai Tourism (DTCM). |

Retirement Scenarios: Paid-Off vs. Leveraged vs. Hybrid

Let’s see how this works in practice. Assume a retirement income goal of $6,000 per month. The strategy you choose will dramatically change the number of properties you need.

Scenario A: The Paid-Off Properties Strategy (High Cash Flow)

Here, the focus is on eliminating debt. With no mortgage, your per-door cash flow is much higher, and your risk is significantly lower.

- Example: A property rents for $1,800/month. With no mortgage, your expenses (taxes, insurance, maintenance, etc.) might be $600.

- Net Cash Flow: $1,200 per month per door.

- Doors Needed: $6,000 / $1,200 = 5 paid-off properties.

Scenario B: The Leveraged Portfolio Strategy (Lower Cash Flow, Faster Growth)

This strategy uses mortgages (leverage) to acquire more properties faster. Your cash-on-cash return is often higher, but your monthly cash flow per door is lower and the risk is greater.

- Example: The same property rents for $1,800/month. But now your expenses, including a mortgage (PITI), are $1,450.

- Net Cash Flow: $350 per month per door.

- Doors Needed: $6,000 / $350 = ~18 leveraged properties.

Scenario C: Hybrid “Snowball” Approach

This is my favorite approach for many clients. You start by buying leveraged properties to scale your portfolio (like Scenario B). Then, as your income grows, you use all surplus cash flow to aggressively pay down the mortgage on one property. Once it’s paid off, you “snowball” its high cash flow to pay off the next one, and so on. This strategy migrates you from a higher-risk growth phase to a lower-risk, high-cash-flow retirement phase.

Honestly, it’s the best of both worlds if you have the patience.

| Doors | Strategy | Avg. Rent | Avg. Expenses | Net Cash Flow/Door | Total Monthly Cash Flow | Risk Profile |

|---|---|---|---|---|---|---|

| 3 | Paid-Off | $2,500 | $800 | $1,700 | $5,100 | Low |

| 5 | Paid-Off | $1,800 | $600 | $1,200 | $6,000 | Low |

| 8 | Hybrid | $2,000 | $1,500 | $500 | $4,000 | Medium |

| 15 | Leveraged | $1,800 | $1,400 | $400 | $6,000 | High |

| 18 | Leveraged | $1,800 | $1,450 | $350 | $6,300 | High |

Key Financial Metrics for Your Real Estate Investment Portfolio

Understanding the financial engine of your portfolio helps you choose properties that reliably produce cash flow and long-term wealth. These metrics connect rental income, ROI (return on investment), yield, and equity growth to market value, appreciation, and the tax benefits that investors rely on to scale their assets.

Cash Flow & Rental Income

This is your foundation. Gross rental income is what tenants pay before any deductions. Net cash flow is what you, the investor, actually keep after all costs are paid. You must track your monthly inflows against all outflows—maintenance, management, and reserves—to ensure the property consistently yields positive cash flow. For retirement, stable net cash flow is non-negotiable.

ROI, Yield & Returns

These metrics tell you how hard your money is working.

- Cap Rate = Net Operating Income / Property Value. This is a quick, back-of-the-napkin gauge of a property’s unleveraged return. It’s great for comparing properties in the same market.

- Cash-on-Cash ROI = Annual Pre-tax Cash Flow / Total Cash Invested. This is the king of metrics for leveraged investors. It tells you the return on your actual cash investment (down payment, closing costs, rehab).

- Total Return. This is the big picture. It includes cash flow, equity built from loan paydown, market appreciation, and tax benefits. It’s more complex to calculate accurately, but it shows the true wealth-building power of your investment.

Equity & Appreciation

Equity is the difference between your property’s market value and your loan balance. It grows in two ways: your tenant pays down your mortgage for you (amortization), and the property’s value increases (appreciation). This equity is potential energy; it can be tapped via a cash-out refinance or HELOC to acquire new assets, but you must balance this desire for growth with the need for stable cash flow.

Tax Benefits

This is a huge, often underestimated advantage of real estate. In many jurisdictions, you can deduct operating expenses, mortgage interest, and even a “phantom” expense called depreciation, which can shelter a significant portion of your rental income from taxes.

“In the U.S., tools like 1031 exchanges can allow you to defer capital gains taxes when selling one property to buy another, a powerful strategy for portfolio growth.” — IRS Publication 527, Residential Rental Property, (2025). irs.gov

Tax-aware planning dramatically boosts your after-tax returns. Note that such benefits are jurisdiction-specific and may not apply in locations like the UAE.

| Metric | Formula | Example |

|---|---|---|

| Cap Rate | Net Operating Income / Price | $12,000 NOI / $200,000 Price = 6% |

| Cash-on-Cash ROI | Annual Cash Flow / Cash Invested | $4,200 Cash Flow / $50,000 Cash = 8.4% |

| Total Return (Simplified) | (Cash Flow + Principal Paydown + Appreciation) / Cash Invested | ($4.2k + $2k + $6k) / $50k = 24.4% |

Crafting a Long-Term Strategy for Your Property Portfolio

A successful retirement portfolio isn’t built by accident. You need to align your long-term strategy with your retirement goals and risk profile to build a resilient collection of assets that compounds wealth over decades.

Residential vs. Commercial Properties

Residential properties (like apartments or single-family homes) often offer easier financing, a larger pool of potential tenants, and simpler management. They’re a great starting point. Commercial properties (like small office buildings or retail spaces) may offer longer lease terms and “triple-net” structures where tenants pay for taxes, insurance, and maintenance. The choice depends on your capital, your team’s capacity, and your target yield.

For those exploring commercial real estate in Dubai, understanding local regulations is essential.

The Importance of Diversification

Don’t put all your eggs in one basket. I’ve seen investors get wiped out by a single factory closure that devastated a local market. Diversify across different markets with different economic drivers. Diversify by property type (e.g., a mix of residential and small commercial). And diversify by strategy (a mix of long-term rentals and mid-term furnished units). This smooths out your portfolio’s cash flow and makes it resilient to shocks.

Developing Your Financial Plan

Your plan is your roadmap. It should be written down.

- Define Goals: Your target income, timeline, and risk tolerance.

- Set Your “Buy Box”: The specific criteria for properties you’ll consider (top areas to invest, price-to-rent ratios, minimum cash flow, minimum ROI).

- Plan Your Capital: How much you need for down payments, reserves, and lines of credit.

- Create an Acquisition Roadmap: A 12-24 month plan for how many properties you’ll acquire.

- Review and Rebalance: At least once a year, review your portfolio’s performance and adjust your strategy.

Comparing Investment Strategies: Long-Term vs. Vacation Rentals

Choosing between long-term (LTR), mid-term (MTR), and short-term vacation rentals (STR) is a critical decision for retirement planning. Each has a different risk and operational profile.

| Factor | Long-Term Rental (LTR) | Mid-Term Rental (MTR) | Short-Term Rental (STR) |

|---|---|---|---|

| Typical Lease | 12+ months | 1-9 months | Daily/Weekly |

| Income Volatility | Low | Medium | High |

| Management Intensity | Low | Medium | High |

| Turnover Costs | Low | Medium | Very High |

| Regulatory Risk | Low | Medium | High (e.g., licensing, zoning) |

| Best for Retirement | High stability, predictable income. | Good balance, caters to corporate clients. | High potential income, but requires active management and higher risk tolerance. |

Key Factors That Will Change Your “Magic Number”

Your “magic number” of properties isn’t static. It will change based on three key variables.

Your Real Estate Market (Location)

Location is everything. A property in a high-growth market like Dubai will have different rent-to-price ratios, taxes, and regulations than one in a slow-growth Midwest town. Landlord-friendly markets with strong job growth and population inflows typically produce much steadier returns and, therefore, require fewer properties to hit your goal. Research shows that markets with diverse economic drivers offer more resilience.

If you’re considering buying property in Dubai, understanding the local market dynamics is crucial.

Your Financing Strategy (Leverage vs. Cash)

As we saw in the scenarios, this is a massive factor. Using leverage (mortgages) allows you to grow faster but cuts your per-door cash flow and increases risk. Paying all cash for properties creates a fortress of stability and high cash flow, but it takes much longer to scale.

Your Personal Risk Tolerance

Are you comfortable with thinner margins for the chance at faster growth? Or do you need the security of high per-door cash flow and massive reserves? There’s no right answer, but your personal risk tolerance will directly influence your strategy and, consequently, the number of doors you need.

“I always tell my clients, especially those investing from abroad, that cash flow is king, but leverage is the kingmaker. The key is finding the right balance for your personal situation. A 25-year-old can take on more leverage risk than someone 10 years from retirement.” — Mike Griffin, Realtor at Anika Property

Stress-Testing Your Portfolio

To build a resilient plan, you must stress-test your assumptions. How would your portfolio perform if interest rates rise or vacancies spike?

| Scenario | Base Case | Interest Rate +2% | Vacancy Rate +5% |

|---|---|---|---|

| Net Cash Flow/Door | $350 | $150 | $260 |

| Doors for $6k/mo | 18 | 40 | 24 |

Risks, Pitfalls, and How to Protect Your Portfolio

Disclaimer: This information is for educational purposes only and does not constitute investment or legal advice. Consult with qualified professionals for guidance.

Relying solely on real estate for retirement isn’t without risks. It’s important to go in with your eyes open and avoid common pitfalls.

Common Risks

- Vacancy and tenant default: Your income can drop to zero overnight.

- Market downturns: Property values can fall, and rents can stagnate.

- Unexpected repairs: A major CapEx event can wipe out years of cash flow.

- Liability and legal changes: A lawsuit or a change in landlord-tenant law can be costly.

- Interest rate risk: If you have adjustable-rate loans, a rate spike can crush your cash flow.

Common Pitfalls to Avoid

- Overleveraging: Taking on too much debt. Fix: Keep your Debt Service Coverage Ratio (DSCR) at or above 1.25x and use fixed-rate debt.

“Lenders typically require a Debt Service Coverage Ratio (DSCR) of at least 1.25x to ensure a property generates enough income to safely cover its debt payments.” — Freddie Mac, Primary Mortgage Market Survey (PMMS), (2025). freddiemac.com

- Underestimating expenses: Forgetting or lowballing CapEx and turnover costs. Fix: Use conservative rules of thumb (like 8-10% for each) and get real quotes.

- Thin reserves: Not having enough cash on hand for emergencies. Fix: Hold 3-6 months of total expenses per property in a separate savings account.

- Wrong market/property: Buying based on emotion instead of data. Fix: Define your buy-box and stick to it religiously.

Protecting Your Portfolio and Your Future

Building wealth is one thing; keeping it is another.

Disclaimer: This information is for educational purposes only and does not constitute legal advice. Consult with a qualified legal professional.

Legal Protection and Entity Setup: Holding properties in your personal name is a risk. Using legal entities like Limited Liability Companies (LLCs) or Special Purpose Vehicles (SPVs) in jurisdictions like DIFC/ADGM can help shield your personal assets from lawsuits related to your properties. Always coordinate with qualified legal protection and tax advisors to choose the right structure for your situation.

Property Management: DIY vs. Professional: Doing it yourself saves money on fees but costs you time. Hiring a professional property management firm costs 8-10% of rent but frees you up to find more deals and stabilizes operations, which is especially critical for overseas investors. If you hire a pro, track their performance with key metrics.

| Aspect | DIY Management | Professional Management |

|---|---|---|

| Pros | No management fee, full control | Saves time, scales easily, professional systems, less stress |

| Cons | Time-consuming, emotional, requires expertise | Costs 8-12% of rent, loss of some control |

| Best For | Local investors with 1-3 properties and free time | Remote investors, large portfolios, busy professionals |

| Key KPIs | N/A | Vacancy Rate, Delinquency, Days on Market, Maintenance Cost/Time |

Test Your Investor IQ

Accelerate Your Timeline: Retire Faster with Real Estate

Want to speed things up? There are several strategies to do just that.

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat): This is a powerful method to recycle your investment capital. You buy a distressed property, fix it up (rehab), rent it out, and then do a cash-out refinance based on the new, higher value. You pull your original capital back out and “repeat” the process on a new property.

- House Hacking: This is the ultimate way to start with low capital. You buy a small multi-family property (like a duplex), live in one unit, and rent out the other(s). The rent from your tenants covers most or all of your mortgage, drastically reducing your personal living expenses and turbo-charging your savings rate.

- Reinvest 100% of Cash Flow: In the early years, don’t spend your cash flow. Reinvest every single dollar back into the business—either by paying down debt faster or by saving up for the next down payment. This creates a powerful compounding effect on your portfolio’s growth.

Frequently Asked Questions (FAQ)

Can I retire on just 2 or 3 properties?

Yes, it’s absolutely possible, but only if each property is a cash-flow machine. This typically means they are paid off or have very low mortgage balances. If you’re using leverage, you will almost certainly need more doors to generate the same retirement income.

How does the “1% Rule” fit into this calculation?

The 1% Rule (where monthly rent should be at least 1% of the purchase price) is a quick, initial screening tool, not a detailed analysis. It helps you quickly discard properties that are unlikely to cash flow. You must always follow it up with a full analysis of actual expenses to calculate true net cash flow.

Is it better to own more cheap properties or fewer expensive ones?

It depends entirely on net cash flow, risk, and your management capacity. Ten cheap properties might generate the same total cash flow as two expensive ones, but they come with ten roofs, ten water heaters, and potentially ten tenant issues. Optimize for stable, after-expense income and a portfolio size you can comfortably manage.

How many rental properties to make $100,000 a year?

Based on our examples, you would need around 20 leveraged properties generating ~$420/month each, or perhaps 8-10 paid-off properties generating ~$1,000/month each. The exact number depends entirely on your net cash flow per door. Use the calculator above to find your number.

Is the 2% rule for rental properties outdated?

For most markets today, yes, the 2% rule is outdated and unrealistic. It suggests a property’s monthly rent should be 2% of its purchase price, which is rarely achievable outside of very low-cost or high-risk areas. The 1% rule is a more common, though still imperfect, screening tool.

“Cash flow funds life; equity funds growth.”

Your Path to Financial Independence Starts Now

Financial independence through real estate investment is not a dream; it’s achievable with a clear financial plan and a disciplined strategy. It starts with defining your targets, understanding your market, and acquiring properties that fit your strict portfolio rules. Smart investors build and compound their wealth by protecting their cash flow and scaling their assets steadily. The first step is the most important.

Take it today.

For those looking to explore high-ROI properties in Dubai, our team can guide you through the process.

Speak with an Investment Advisor

Our Investment Specialists

Laura Lavinsky

Realtor

Mike Griffin

Realtor

Zoe Hernandez

Realtor